4 Secret Ways to Beat Other Offers

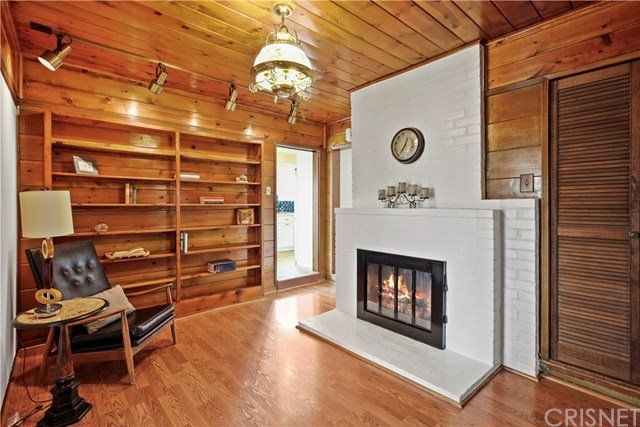

Lately I have become angered by watching CNN talk about the housing market. “Home prices are still dropping” -etc, etc, etc. Take it from someone in the business- home prices are NOT falling, at least not in LA. If you are a buyer these days you had better be prepared to bring the big guns to the table when writing an offer – low-ball offers are a thing of the past!

Inventory is extremely low as the market makes it’s shift. In my opinion, it’s already turned to a Seller’s Market as many properties are going all cash and/or over asking.

Here are a few tips taken from Trulia.com that will help you in this insanely competitive market.

1. Offer More Than Asking (if the market data justifies it). It’s entirely possible that you’re shaking your fist right now, yelling something like: “You said these were ‘secret’ strategies!” Allow me to explain: offering more money *seems* like a super obvious way to beat out other offers, but you would be amazed at how many bargain-seeking, recession-trained and novice buyers simply don’t do it. Many think they’re scoring a deal by making low offers, even in the face of competition.

Essential Home Buying Truth: If you lose out on five homes before the market educates you to get ‘unstuck’ from your rigid, lowball offer strategy, you might end up facing even more competition for fewer homes a few months down the road – and end up spending even more to finally score a property. Make sure to involve your agent and mortgage pro and financial advisor up front to ensure you don’t overextend yourself. In more recession-proof areas, you may need to go so far over asking that you’ll need to adjust your house hunt price range lower to be able to compete. Of course, the recent sales data and your personal budget must all justify whatever amount you offer; otherwise, you’re just cruising for a bruising down the road when it comes time to have the place appraised – or make the monthly payments.

If you find the mere thought of offering more than the list price exasperating, keep things in perspective. Know that smart sellers are being very strategic and assertive, listing low to create an auction atmosphere and churn up multiple offers. Don’t be duped into thinking you can get away with a low offer because the asking price seems like such a bargain.

Some of these seemingly lower-priced homes are getting 20, 30, even 50 offers in some areas (no joke!). The victorious buyers are those who are offering amounts backed up by the home’s fair market value, as determined by the very, very most recent sales – not sales from six months or a year ago.

2. Max out and show off your close-ability. Yes: sellers care about getting top dollar for their homes, so offer price is the primary factor that makes or breaks your offer. However, sellers and their agents are uber-aware of the flip side: a great deal that doesn’t close is no deal at all.

Deal Killers:

- low appraisals

- mortgage approval failures, and

- condition problems revealed by inspections

Strategic moves that can make your offer stand out above the rest:

- shortened contingency periods (which mean the seller will get certainty that you’ll close the deal sooner than later) ie: 10 day inspection time

- documenting that your over-asking offer price is backed-up by nearby comparable sales (minimizing the risk of later appraisal problems)

- making an all-cash or high-down payment offer (if your resources allow)

- offering to buy the home as-is (so long as you retain your inspection and loan contingencies) or even

- obtaining inspections, appraisals or repair bids before making an offer and waiving the relevant contingencies up front.

CAVEAT: I put these strategic suggestions out there to let you know that they are possible and know that they are seen as offer strengths by sellers. They are not always advisable and, in some cases, are actually unwise and inadvisable, in that they waive rights you might need to exercise in the future depending on the property and the facts of your finances and your life.

3. Work with a well-respected agent and mortgage pro.

Collectively, the buyer’s agent and mortgage broker have a huge impact on how smoothly a transaction goes – and, sometimes, on whether it closes at all.

4. Express your love for the home. Buyers can write love letters, too! Allow me to be frank: if someone is offering $50,000 more than you are, chances are slim that you’ll beat their offer out with a letter or a YouTube video of your trio of pugs or smoke signals, no matter how poignantly they:

- tell the sellers about yourself or your family

- express how much you love their home and

- paint the picture of why it would be such an ideal setting for the next phase of your life.

But – such a love letter may not hurt. In fact, it might even score you a counter-offer in a situation where the seller might otherwise have just outright accepted another, much-higher offer. And your offer price is close or identical to your competitor’s? It might just score you a home.

So there you have it! Some tips on how to score that home. If you have any questions or are looking to purchase a home or sell your current one please contact Brittany at 310.956.9385 or visit the website for additional information.

Brittany Sells LA