5 Possible Financial Incentives For Buying a Home

I know I’ve blogged about this before, but perhaps you need a reminder of all the wonderful benefits of purchasing a home! …so here goes with a few potential tax benefits:

— Mortgage Interest Deductions

As long as your mortgage balance is smaller than the price of your home, mortgage interest is fully deductible on your tax return. Interest is the largest component of your mortgage payment. In some cases, you may also deduct homeowners association fees and property taxes.

— Property Tax Deductions

Real estate property taxes paid for a first home and a vacation home are fully deductible for income tax purposes. In California, Prop 13 limits property tax increases to 2 percent per year or the rate of inflation, whichever is less.

— Capital Gain Exclusion

If you’ve lived in your house for two of the past five years, you can exclude up to $250,000 for an individual or up to $500,000 for a married couple of profit from capital gains.

— Preferential Tax Treatment

If you receive more profit from the sale of your home than the allowable exclusion, that profit will be considered a capital asset as long as you owned your home for more than one year.

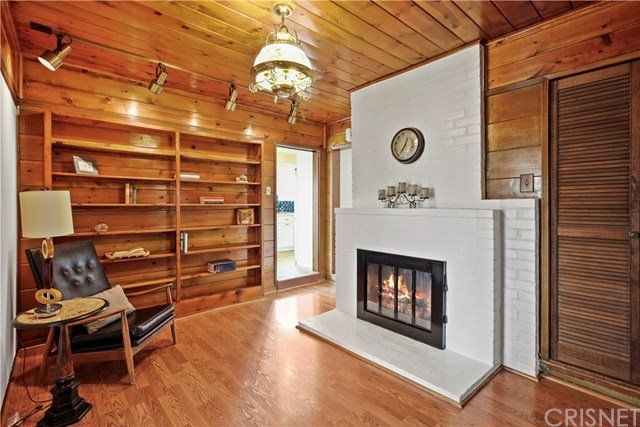

— Building Equity

Over time, you may be able to use the equity you build to fund home improvements, or pay off other, higher interest debts, such as credit card debts or student loans.

For more information on the homebuying process, please contact Brittany at 310.956.9385

Source: CurbedLA

Brittany Sells LA