Advantage of Homeownership: Tax Breaks!

To ensure you are getting the maximum value out of your home – make sure you are taking these simple deductions that could save you big come tax season!

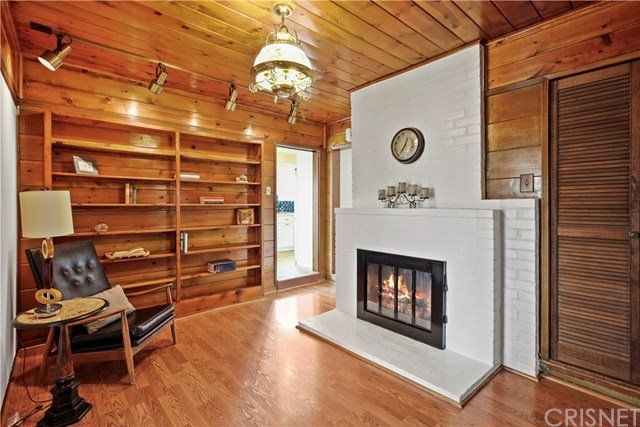

Mortgage Interest – Reduce your taxable income by the amount of mortgage interest you pay.

Private Mortgage Insurance – PMI – This amount is likely fully deductible if your adjusted gross income is is $100,000 or less. Anyone making over this amount can still take a partial deduction.

Energy Efficient Home Improvements – Most people forget about these but yes, they are a deduction you can take! If the improvements meet the federal Energy Star program of 2011 you can get a credit up to 10% the product’s cost.

Points – If you have a new mortgage, the charges you pay in points to get that mortgage are usually deductible.

Property Taxes – As long as the taxes are based on the assessed value, you can take this deduction. If you feel your home value has decreased since you first purchased the property, you can always obtain a reassessment and if the property appraises for less than you purchased it for, you are able to reduce your property taxes. If you want more information on this, please feel free to reach out as I can provide some referrals to this service.

For more information, please contact your local tax preparer or the IRS.

Information provided from the LA Times

Brittany Sells LA