Do you want to be an official, proud homeowner in just a year?

So, you want to be a proud new homeowner in 1 year? Here’s a look, month by month, at what you should be doing as you count down to buying a home!

Month No. 1: Check your credit report.

1. Review your credit report.

2. Build and enhance credit.

Do you need to increase your score? Do you have enough credit? What can you do to solve both of these issues?

Before you contact a real-estate agent or mortgage lender, you need to know if your credit is good enough to qualify for a mortgage. This way you’ll have time to improve your score.

Month No. 2: What can you afford?

1. What’s your income?

2. Assess your debts.

3. How much savings do you have?

-Tally up all debts, short and long term. Paying down your debts will improve your credit score. Compile a budget that allows you to save more, should you need it. In this market 20% down in preferred (plus you’ll save each month on not having mortgage insurance) however you can still go FHA or a 5%, 10% or 15% conventional.

4. What type of mortgage fits your needs?

– Perhaps the most important question you need to answer honestly when you’re thinking about buying a home is, “How much house can I afford?” Take inventory of your monthly income versus your monthly debts as well as your savings to figure out how much you can put toward a down payment and how much you can afford to pay each month. Also, this is a good time to assess your goals and plans to help you determine which loan product will best fit your needs.

Month No. 3: What kind of home do you need?

1. Consider transportation options?

2. How are the schools rated?

3. What amenities do you want?

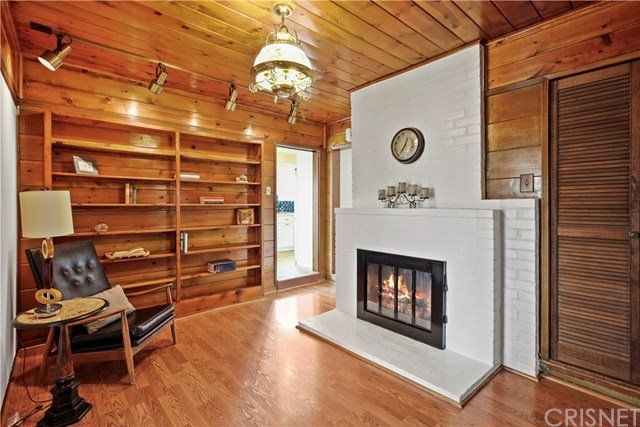

Think about your must-have items, including number of bedrooms and bathrooms, size, fireplace, eat-in kitchen, etc. Do you want an turn-key, move-in ready home or a fixer?

Month No. 4: Research housing stock

1. What neighborhoods do you want to live in, what’s the inventory like in those areas?

2. Review the market’s “price supports” – jobs, schools, shopping.

At this stage of the game, it’s time to start researching the local housing stock. Viewing homes online is a good way to see what types of homes are available in a neighborhood, but remember that online pictures can be deceiving. Save yourself and your agent a lot of time by driving past the property before you agree to see it together.

Month No. 5: Find a Realtor & Get a Preapproval – This is where I come in!

1. Have your agent walk you through the process and answer any questions you might have. You want to be fully prepared when you are ready to buy! in today’s market, you should allow yourself 3-6 months to find the right home and move completely in.

1. Which lenders are in your area?

– Start by researching local lenders, then expand the search if necessary. (Your agent should be able to provide great references. It’s always preferred to go with a lender your Realtor knows and trusts. It will make the transaction that much smoother).

2. Get you preapproval.

– This is where you will bring in your documentation. You can not put in offers on a property without this. You will need to bring the following to your lender:

1. Tax Forms – At least the last 2 years

2. Asset Statements- Get copies of you most recent savings accounts, stocks, bonds, and so on. You’ll also have to provide updated statements again once you get closer to closing.

3. Income Statements

Month No. 6+ : Look for Homes!

Each market is totally different. In Los Angeles, we are experiencing low inventory right now. I would estimate there are at least 10-15 buyers for every one home on the market currently. You must be ready, willing, and able to do what it takes to get an offer accepted. This is why I would allow up to 6 months (if you are not looking every week) to find a property. If you are aggressively looking, ready to write offers sometimes above asking, and do what it takes, you should be in your new home within 3 months. Remember, once you get an offer accepted, escrows generally last at least 30-35 days.

You should also plan accordingly with your landlord. You definitely don’t want to be paying rent and a mortgage. Talk to you landlord on move out dates.

For more information, call us at 310.956.9385 or click here to visit the website to search for homes in Los Angeles.

These steps can also be done more quickly, let’s say in 6 months if you have a specific time you want to buy. You also need to be stacking money away for that downpayment. Typically here in Los Angeles, buyers put down 20%. This is a sure way to avoid the extra expense of mortgage insurance. If you plan and budget your year out, you’ll meet your goals when the time comes.

Brittany Sells LA